Nike, the global sportswear giant, recently experienced a challenging first quarter with revenue down 10% year-over-year to $11.6 billion after CEO John Donahoe stepped down and faced cuts. Major leadership change The company’s direct-to-consumer (DTC) business took a hit. Nike Direct revenue fell 13%, mainly due to a sharp 20% decline in its digital business.

In addition, wholesale revenue fell 8% overall. $6.4 billion According to the company’s latest disclosure.

The Return of Elliott Hill

As Nike prepares for this transition, veteran Elliott Hill will take over as CEO after spending 30 years with the brand. Hill brings a deep connection to Nike’s culture and people, according to Matt Friend, Nike’s Chief Financial Officer. They expressed optimism about Hill’s leadership, emphasizing that he commands widespread respect within the company and among retail partners.

The friend revealed that the company is realistic about the challenges ahead, but believes Nike is positioned to forge a new growth path under Hill’s leadership. “We expect it will take us some time to bounce back. to strong growth,” Friend said, noting that the foundation is in place to drive future success.

Nike's Strategic Reset: Fixing Core Business Areas

To tackle ongoing challenges, Nike is concentrating on enhancing its brand marketing and improving its product innovation processes. The company has also decided to reduce its core footwear lineup, which includes the iconic Air Force 1, Air Jordan 1, and Dunk, to better manage supply.

Especially in the company’s own channels. While this resulted in a 50% year-over-year sales increase – Nike’s decline in digital sales of these products was on the brighter side. The wholesale trend has better results.

Tackling the Running Category

Nike admits that the running category has been one of his toughest challenges over the past two years. Despite positive growth in the first quarter, But the company continues to lose market share and is struggling to gain traction with everyday runners. Mitra stressed the importance of the category, saying, “Nike is a company that runs. And it was important for us to win with the runners.”

The company is committed to revitalizing this group. While they acknowledge that progress will not happen overnight.

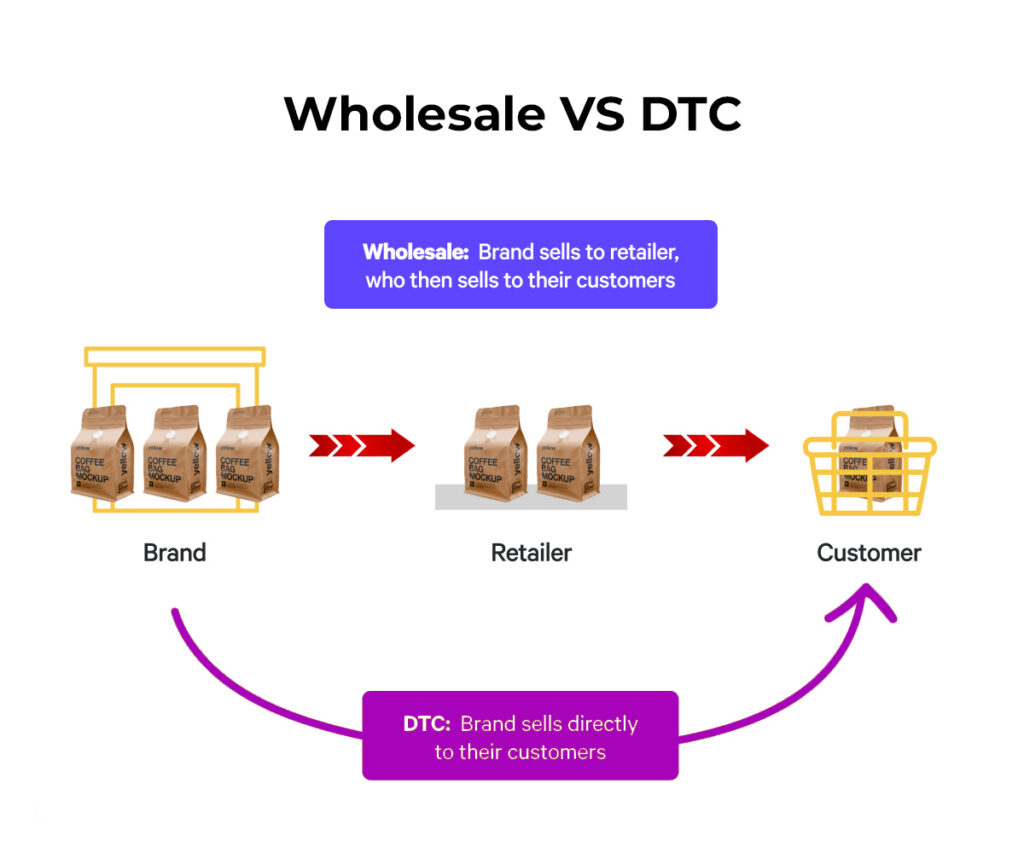

Balancing DTC and Wholesale

Nike continues to refine its direct-to-consumer approach, though. But it is also building relationships with wholesale partners. The company sees similarities between its current strategy and moves made in 2010 when Elliott Hill leads efforts in North America. Nike’s focus on rebalancing the sports market has led to significant growth. Miter emphasized that both digital and direct channels are important to Nike’s strategy, but added that Building strong relationships with consumers is key. whether through its own platform or reseller partners.

A Long Road to Recovery: No Quick Fixes for Nike

Even though it has been implemented Nike’s recovery will take time. Friend admits that although there are signs of recovery the sheer scale of the company’s problems means there are no quick fixes. Neil Saunders, managing director of GlobalData, echoes this sentiment. They said Nike’s size and complexity made rapid change challenging.

Saunders points out that critical areas such as the innovation pipeline are complex processes that cannot be rushed. This means Nike is facing an underperforming year. Hoping to get better results ahead The company is optimistic, though. But patience will be the key to becoming the market leader again.

Wrapping Up

Nike is in the midst of major change. Faced with leadership changes and business challenges Under Elliott Hill’s leadership, the company is taking a long-term approach to repositioning the business. It focuses on strengthening key areas such as brand marketing, product innovation, and scope of operations.

Related Blog – retail supply chain Shortages in 2023: 4 goods facing tight supply this year